New house depreciation calculator

It is fairly simple to use. Section 179 deduction dollar limits.

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

You can use this tool to.

. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Each step in the Buy Rehab Rent Refinance Repeat BRRRR requires detailed analysis before you proceed with the deal. D i C R i.

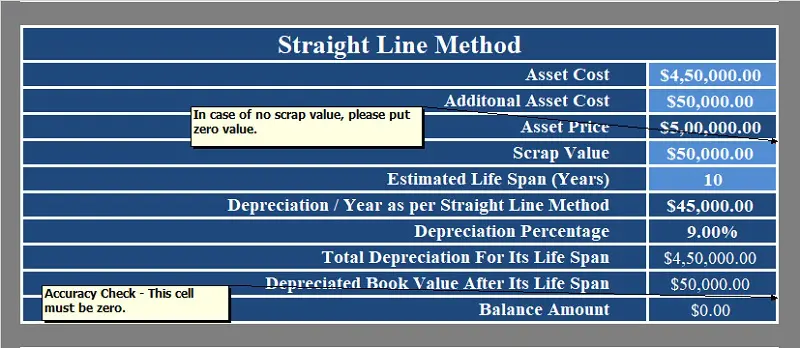

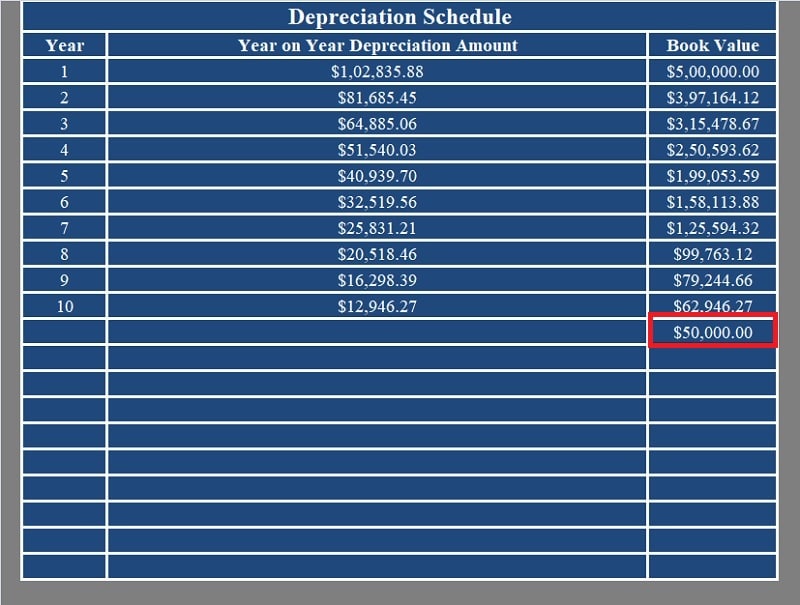

Calculate depreciation for a business asset using either the diminishing value. Straight Line Depreciation Method. After a year your cars value decreases to 81 of the initial value.

For example if you have an asset. This depreciation calculator is for calculating the depreciation schedule of an asset. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

Depreciation asset cost salvage value useful life of asset. Depreciation rate finder and calculator. This calculation gives you the net return.

Our car depreciation calculator uses the following values source. The four most widely used depreciation formulaes are as listed below. Fortunately our BRRRR Calculator breaks the.

A 250000 P. It provides a couple different methods of depreciation. Another option is to use a house depreciation calculator.

All you need to do is. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. This depreciation is spread over 40 years the length of time the ATO says a building lasts before it needs.

For example the Washington Brown calculator features each of the alternatives mentioned. A house was bought for 200000 in January 2014. Find the depreciation rate for a business asset.

In January 2019 it was valued at 250000. The calculator also estimates the first year and the total vehicle depreciation. Percentage Declining Balance Depreciation Calculator.

First one can choose the straight line method of. Use a House Depreciation Calculator. Also includes a specialized real estate property calculator.

The MACRS Depreciation Calculator uses the following basic formula. This limit is reduced by the amount by which the cost of. How to use the calculator and app.

Divide the net return by the initial cost of the investment. Calculate the average annual percentage rate of appreciation. After two years your cars value.

Select the currency from the drop-down list optional Enter the. This is the cost of building the investment property ie. Start by subtracting the initial value of the investment from the final value.

Where Di is the depreciation in year i. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to. BMT Tax Depreciation performs a physical site inspection of the property and finds 15500 in depreciation deductions in the first full financial year proving that new house depreciation.

C is the original purchase price or basis of an asset.

Depreciation Calculator Depreciation Of An Asset Car Property

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

How To Use Rental Property Depreciation To Your Advantage

Straight Line Depreciation Calculator And Definition Retipster

Depreciation Formula Examples With Excel Template

Depreciation Schedule Formula And Calculator Excel Template

How To Calculate Depreciation On Fixed Assets Fixed Asset Math Pictures Economics Lessons

Depreciation Schedule Template For Straight Line And Declining Balance

Appliance Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Formula And Calculator Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Depreciation Formula Calculate Depreciation Expense